Source: http://geology.com/

Lithium-bearing pegmatites have been found in Araçuaí, São João del Rei and the Governador Valadores districts of Minas Gerais, in Brazil. The Araçuaí district contains more than 300 pegmatite deposits, including the Itinga field, which hosts the lithium-bearing pegmatites at the Cachoeira mine. Lithium-bearing pegmatites are also present in large areas of Rio Grande do Norte and Ceara states in Northeastern Brazil.

- AMG (Advanced Metallurgical Group NV) (AMG:NA) is entering the lithium market with an investment of approximately $50 million in the construction of a lithium concentrate (also known as spodumene) plant at its existing Mibra mine in Brazil. Leveraging its existing mining infrastructure in place at Mibra (which has been in operation for almost 40 years), AMG’s goal is to be the low-cost producer of lithium concentrate globally. AMG can recover lithium-bearing materials from the existing and future tailings at its profitable tantalum operations at Mibra, with the ore extraction and crushing costs absorbed by the tantalum operations. AMG has successfully operated a lithium pilot plant since 2010, with more than 2.8 million tons of spodumene feed stock having been extracted. AMG has successfully operated a lithium pilot plant since 2010, with more than 2.8 million tons of spodumene feed stock having been extracted. Phase I of the project involves the construction of a lithium concentrate plant to produce 90,000 MT of spodumene per year, with operations expected to commence in the first half of 2018. Phase II would entail increasing the annual production of spodumene from 90,000 MT to 180,000 MT per year. Phase 3 of the project would see AMG expand its operations into downstream market via construction of a lithium chemical plant. The recent mineral resource estimate for Mibra (published in April 2017 and prepared in accordance with National Instrument 43-101 Guidelines) identified 20.3 million MT of measured and indicated resources, which includes lithium, tantalum, niobium, and tin. As AMG has already processed the material to extract tantalum, the incremental cost to extract spodumene is marginal. At an estimated $135 per tonne, AMG’s cost of production is close to industry heavyweights and it offers strong profitability potential against a current market price of $700-$800. At full capacity, this means the lithium project could add $105-120m to group operating profit – a very significant contribution in the context of the $80m generated in 2017.

-

Companhia Brasileira de Lítio produces and markets lithium carbonate. The company was founded in 1986 and is based in Divisa Alegre, Brazil.

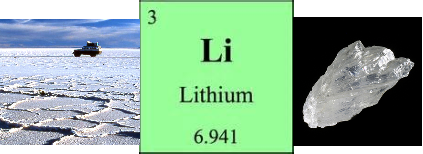

- Crusader Resources Ltd (ASX: CAS) has signed a joint‐venture Shareholders Agreement and finalised the terms of associated documentation with Lepidico Ltd. The new company, to be known as Third Element Metals, is aiming to become a producer of the third element in the periodic table, namely lithium, with an immediate focus on Brazil. Under the agreement, which follows on from signing of the Memorandum of Understanding the shareholders have agreed to establish a 50:50 strategic joint venture to explore for and develop lithium resources in the Territory. Third Element Metals will have exclusive rights to use the L‐Max® technology, a patented technology to extract lithium from mica ores within the Territory. The company intends to develop and hold a portfolio of lithium projects and or royalty interests from sub‐licencing the technology in addition to deploying it to Crusader’s Manga prospect.

-

Sigma Lithium Resources currently has a NI43101 compliant resource of 13.5 million tonnes at 1.56% Li2O at the Xuxa mine. Xuxa is one of six priority lithium deposits sites at Grota Do Cirilo and Sigma plans to increase the resource at the property from 40 to 50 million tonnes with further drilling. The mining company has identified more than 200 pegmatite bodies on all properties.