Source:

Geology.com

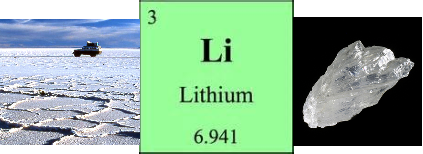

The

Salar de Atacama, in northern Chile, is a 3,000 km2 desert

salt basin and the world’s largest producer of lithium. Two

companies, Sociedad Quimica y Minera (SQM) and Rockwood Holdings,

Inc., extract lithium from this brine. SQM has a claim of ~820 km2

and two operations in the nucleus. It currently produces lithium from

its south-western operation. Rockwood has a claim of ~137 km2

and one operation in the south-east, part of which is devoted to

lithium extraction. A buffer zone ofaround 100 km2

separates the two companies’ claims. Atacama’s salt nucleus, in

the southern half of the salar, is a layer of halite (salt) with an

area of around 1,400 km2 and a thickness of around 360 m in the

center of the basin. In the uppermost 30 to 40 m of the halite layer,

there are abundant pores between the halite crystals. This porous

zone is referred to as an aquifer, and it contains a very saline

solution (brine) that contains from 900 ppm to 7,000 ppm of lithium,

the world’s highest known concentrations in brines of this type.

Brine outside of this nucleus has lower but still important

concentrations of lithium, up to 1,000 ppm. Recent estimates for

reserves of lithium in the aquifer range from 1.0 to 7.25 Mt. Tahil

estimates that the aquifer contains 1.0 Mt of lithium. SQM estimates

that their claim contains 6.0 Mt of lithium reserves. Including SQM’s

and Rockwood’s claims, the buffer zone, and a portion of the area

to the north of the nucleus containing 400,000 tonnes of lithium,

Evans estimates that the salar contains a total of 7.0 Mt of lithium

reserves. Yaksic and Tilton also accept this estimate. Clarke and

Harben have a slightly higher value of 7.25 Mt but provide no

information on why they increased the estimate.

Companies

active in Chile

Albemarle

Corporation

Sociedad

Chilena Del Litio Limitada

Sociedad

Quimica y Minera

(NYSE:SQM

Wealth Minerals (WML:CN)

SQM finally ended an almost four year long

dispute with the Chilean Government, with the latter allowing the

company to expand their lithium production quota from around roughly

50-60K tonnes today up to 216,000 tonnes per annum (tpa) through 2025.

As a result of this news, the markets responded by selling off lithium

stocks across the board out of worries of an oversupply caused by SQM

flooding the markets.

Talison Lithium (Tianqi Lithium Corporation-51%, Abemarle-49%) Wealth Minerals (WML:CN)