Lithium Outlook 2018: Higher Supply and Demand

Demand for electric cars continued to grow in 2017, and lithium, a key metal used in the batteries that power them, performed better than many expected.

Investor interest in the metal surged as lithium and electric vehicles (EVs) made news headlines throughout the year. Prices were up, and many TSX- and TSXV-listed stocks jumped over 100 percent in 2017.

Price performance review

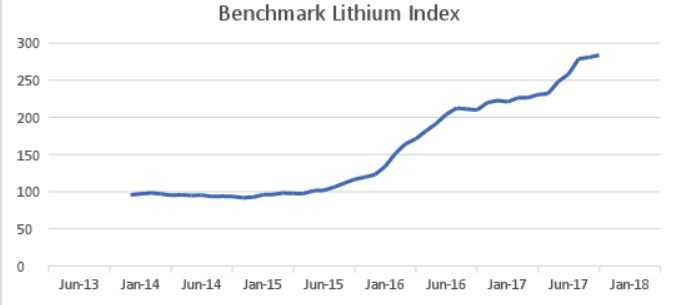

Looking back at how lithium prices performed in 2017, it’s clear that prices remained strong throughout the year. As the chart below from Benchmark Mineral Intelligence shows, that has been the trend for the last few years as well.

Source: Benchmark Mineral Intelligence.

“The continued pricing strength in lithium has been a surprise,” said Chris Berry of House Mountain Partners and the Disruptive Discoveries Journal. He added that his previous demand forecast out to 2025 for lithium ended up being too low.

“I thought the lithium market (on a LCE basis) would grow to roughly 550,000 tonnes per year, [but] in the middle of the year I adjusted this upwards to 617,000 tonnes by 2025. This still appears too conservative based on potential gigafactory-scale expansion,” he added.

In fact, Benchmark Mineral Intelligence is now tracking 26 megafactories, up from just three back in 2014. The combined planned capacity of these plants is 344.5 GWh. To put that into perspective, total lithium-ion cell demand in 2017 is estimated at 100 GWh.

While that number might seem high, global lithium-ion battery demand is expected to grow between six and seven times by 2026, which will require a battery pipeline of nearly double what exists today.

“We said a few years ago that the present lithium price run will continue, and it has. It has, and it’s gone into a second phase now,” Benchmark Mineral Intelligence Managing Director Simon Moores told the Investing News Network at this year’s Cathodes conference.

“Quite simply, there’s not enough supply to meet the demand, and the demand is increasing quicker than the supply is. Much, much quicker. Therefore, lithium’s price will remain strong for some time,” he added.

For his part, lithium expert Joe Lowry said in his Lithium in Review report that “2017 was a year when virtually all the positive surprises were on the demand side and most of the negative surprises were on the supply side.” The expert also recently explained that the “Star Alliance of the lithium market” was one of the major trends this past year.