Over the last two decades, the lithium-ion battery has caused a transformation in the consumption of metals and minerals. The landscape is expected to change further as the Li-ion battery evolves from low portable applications, such as the mobile phone with a small 10 watt-hours (Wh) pack, to the electric vehicle with a battery capacity of 50kWh, and to the monster Electronic Storage System (ESS) with up to 10MWh battery banks. Tesla's battery factory in Nevada alone will need about 24,000 tonnes of lithium hydroxide annually, according to Benchmark Mineral Intelligence, out of a total market of 50,000 tonnes in 2014. At the start of the millennium, only a small percentage of cobalt and lithium went into batteries but by 2015, 46 percent of cobalt and 32 percent of lithium went into Li-ion production. The current market standard for electric vehicles is an eight-year warranty to retain 80 percent of the original capacity of the battery.

It

is also expected that the global energy storage market will double

six times between 2016 and 2030, rising to a total of 125

gigawatts/305 gigawatt-hours. This is a similar trajectory to the

remarkable expansion that the solar industry went through from 2000

to 2015, in which the share of photovoltaics as a percentage of total

generation doubled seven times. Eight countries will lead the market,

with 70 percent of capacity to be installed in the U.S., China,

Japan, India, Germany, U.K., Australia and South Korea.

Projected electric vehicle sales 2017 - 2030

Source: Bloomberg

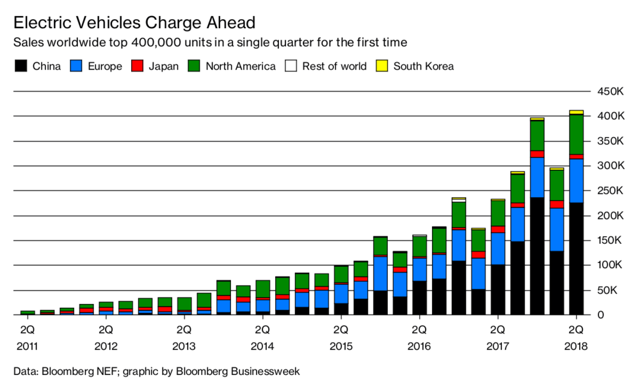

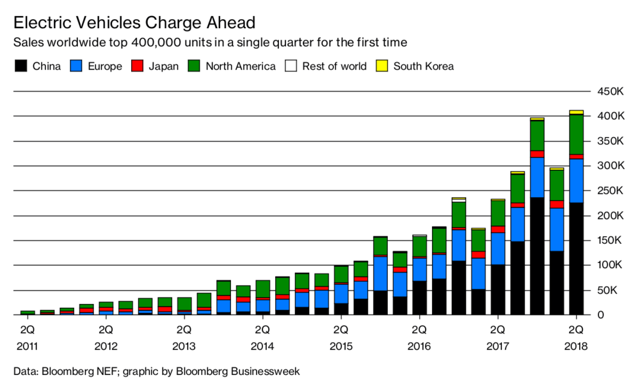

Global

sales of electric vehicles (EVs) are forecasted to increase from 1.1

million in 2017to 30 million in 2030, according

to

Bloomberg

Source: Bloomberg

The expected global market share of lithium ion battery makers in 2018 :

Toshiba (TSE:6502) is developing a “next-generation” lithium-ion battery with an anode made of titanium niobium oxide. According to Toshiba, this new anode material will allow it to create lithium-ion batteries with double the current anode capacity.

Forecasts are for electric vehicle (EV) battery demand to jump 20-fold over the decade to 2025. Cobalt has more than doubled in price over the past year on strong demand and a supply shortage. and surging demand for EV batteries could add some 10% to 40% to current nickel demand by 2025. Demand for nickel from lithium-ion batteries may rise to more than 190 000 metric tons a year by 2030 from about 5 200 tons in 2016. Panasonic which employs nickel-cobalt-aluminium (NCA) technology for customers including Tesla, is making efforts to reduce cobalt consumption. Popular nickel, manganese and cobalt (NMC) lithium-ion batteries typically employ a ratio of 60% nickel to 20% cobalt and 20% manganese, or 6:2:2. China’s EV battery producers such as BYD are focused on cheaper lithium-iron-phosphate (LFP) batteries that don't use either nickel or cobalt. The market is shifting towards NMC and NCA batteries which offer a better power-to-weight ratio, raising similar issues of improved technology to boost nickel usage. Fully electric vehicles also require four times as much copper as cars that run on combustion engines.

The expected global market share of lithium ion battery makers in 2018 :

- Panasonic Sanyo - 33%

- LG Chem - 17% and building a factory in Poland in 2018, the first in Europe.

- Samsung - 9%

- Wanxiang (A123) - 5%

- GS Yuasa - 3%

- Lishen - 3%

- CATL claims to be the world's third largest manufacturer.

- Energy Absolute PCL, based in Thailand, a company developing solar projects, confirmed that it is preparing to spend up to $2.9 billion on a battery factory project that could produce up to 50 GWh of lithium-ion batteries per year.

- Terra E Holding GmbH is to build a 34 gigawatt-hour battery factory. A consortium of 17 German companies with government support will break ground in the fourth quarter of 2019 and reach full capacity in 2028.

- Northvolt AB of Sweden is planning to be the largest battery factory in Europe.

-

Scientists from Stanford University, two Department of Energy national laboratories and Samsung have teamed up to study lithium-rich batteries in the hope of creating super-batteries that will help power electric cars for up to 50% farther.

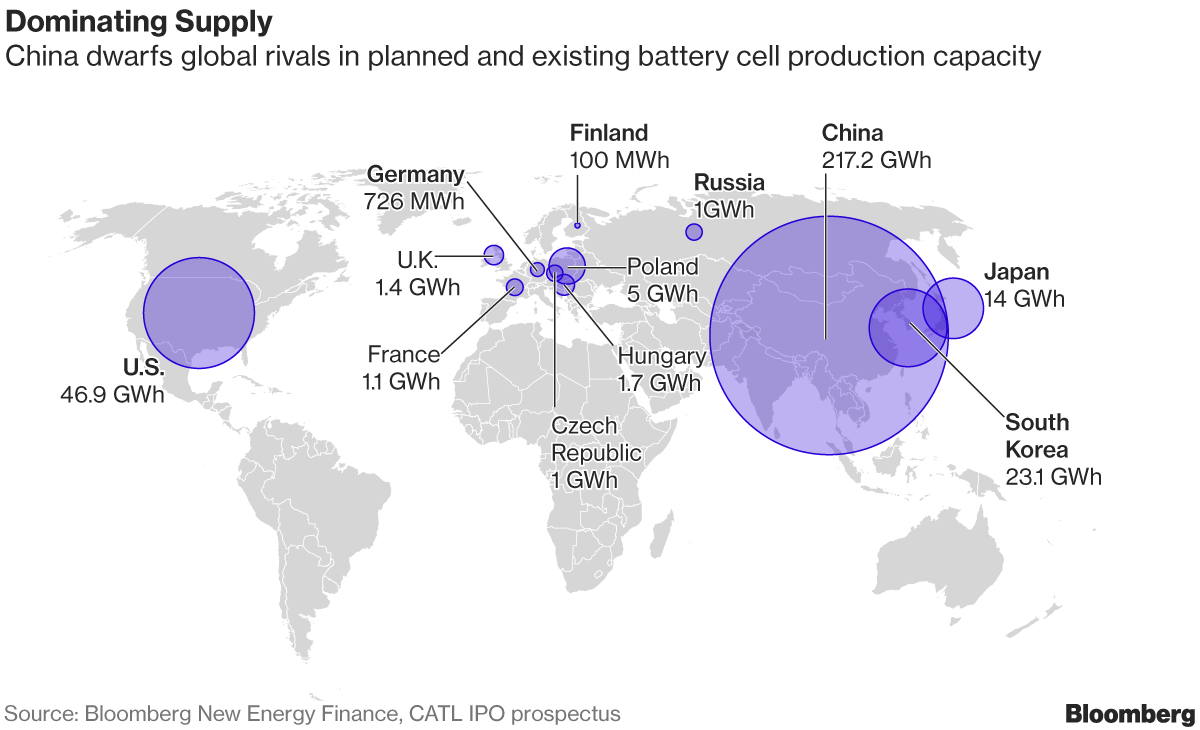

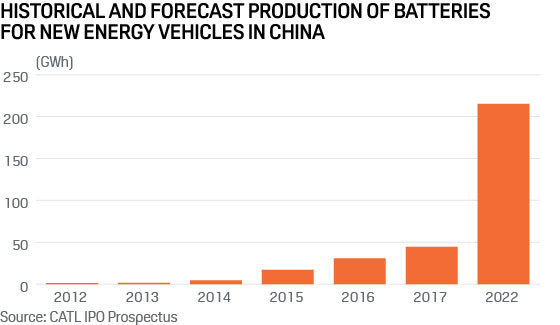

Benchmark

Mineral Intelligence was only tracking 25 megafactories in July 2017,

but that number increased to above 40 in July 2018. In terms of where

most capacity is located, China continues to lead the space, with

about 55 to 60 percent of the megafactories tracked by Benchmark

located in the Asian country. In second place is Europe, with about

15 to 20 percent.

How do lithium batteries work?

Toshiba (TSE:6502) is developing a “next-generation” lithium-ion battery with an anode made of titanium niobium oxide. According to Toshiba, this new anode material will allow it to create lithium-ion batteries with double the current anode capacity.

Nano One (NNO:CN) has dicovered a simple way to assemble low cost materials into nanostructured materials for longer lasting energy materials for lithium ion batteries.

Additional

information on lithium-ion batteries:

The production and use of electric cars is projected by Morgan Stanley analysts to rise to 2.9 percent of 99 million new vehicles in 2020 and to 9.4 percent of 102 million new vehicles in 2025, from 1.1 percent of 86.5 million in 2017. By 2050, 81 percent of 132 million new auto sales will be electric, Morgan Stanley believes. Growth in EV applications alone could triple the size of the entire lithium market from 160,000 mt today to 470,000 mt by 2025, according to Goldman Sachs. China accounted for more than 40 percent of electric cars sold in the world, with more than double the number sold in the U.S. in 2016, according to the International Energy Agency's Global EV outlook 2017.