INN:

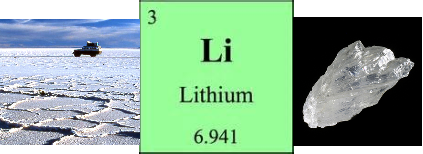

In terms of the general market, do you still believe that the

lithium-ion battery demand will grow to 100,000 metric tons by 2020?

JL: I recently have updated that number to 130,000 metric tons. I believe in 2015 the total lithium market was approximately 163, 000 metric tons and will grow to about 182,000 metric tons in 2016. I only use lithium that was sold as a chemical. If someone uses ore in an end-use it’s not in my numbers. I presented the new numbers at a Benchmark Minerals event in Silicon Valley early this month. The 130,000 metric tons for lithium-ion battery, includes use in all forms of cathode plus the lithium values going into electrolytes, etc. My lithium ion demand forecast actually cuts down the estimates of demand from cathode and battery producers substantially – which is something I have always done.

INN: Such a huge increase. Where do you see most of that production coming from?

JL: When you talk about a huge increase–if the Tesla gigafactory is successful–that’s approximately 28,000 metric tons of lithium hydroxide. And, as I often say, Tesla is (NASDAQ:TSLA) a story, it’s not the story because how many electric vehicle (EV) manufacturers do you have in China? Short answer: probably too many. Currently, China in the EV world is kind of like the US was in the early 1900’s when there were more than 100 car companies and rationalization was needed. Rationalization will ultimately happen in China but volume growth in EV is going to occur. More broadly, demand growth is going to come from electric transportation which is not just EV: it’s buses, it’s delivery vehicles, it’s scooters. I think we are getting to the moment when the electric transportation market is achieving critical mass. Energy Storage Systems (ESS) isn’t going to be a big part of the number to 2020. By 2025 I think it will be a very significant number.

INN: Where is the raw material going to come from?

JL: That’s the $64,000 question. I have a really hard time–even with my moderate 2020 demand number of 312,000 metric tons keeping the supply ahead of demand in my model. It stays in balance to 2020 only with substantially more hard rock capacity – Mt. Marion, Mt. Cattlin and later Pilbara converted to lithium chemicals in China for the most part. The number of suppliers will increase. Companies like Ganfeng and Tianqi will be increasingly significant. Others like FMC who fail to expand resource capacity will decline in significance.

It’s

funny, when Luke Kissam [CEO of Albemarle (NYSE:ALB)]

says, “I’m going to get half the growth,” he is just throwing

out a percentage with no path to get there. If

you look at the demand growth numbers – if Albemarle bought

Orocobre (TSX:ORL)

and Galaxy (ASX:GXY)

– acquiring Mt Cattlin and developing Sal de Vida, operated La

Negra 2 at capacity, and went forward with La Negra 3, they still

wouldn’t get 50 percent of the growth. The timing doesn’t

work. Demand grows too fast. Project execution takes time.

By

2020 the only new brine capacity Albemarle is going to have is La

Negra 2.

Albemarle recently

made an acquisition in China that will close early next year. They

will get 15,000 metric tons of capacity, but they were already

selling those lithium carbonate equivalents as spodumene via their

interest in Talison. They can’t reasonably claim that as part of

getting 50 percent of the growth because they already had that

business. Of

course, they will have an upgraded margin on those lithium carbonate

equivalents. They’re not just going to be selling the spodumene;

they’ll be selling the lithium chemicals and they’ll have margin

growth because of it, but it is double counting to say, “ok that’s

another 15,000 metric tons of capacity we have.” Again,

absent an acquisition of more lithium raw material sources, the only

real growth they have in the next few years is La Negra 2–that’s

20,000 metric tons. So,

if the lithium-ion battery market grows 130,000 metric tons, they get

less than 20 percent of the growth. Even if you wanted to stretch it

and say we’ll count the 15,000 metric tons, with the margin upgrade

in China–that’s 27 percent percent of the growth, assuming my

growth number. If

you go out to 2025, it gets harder to achieve the 50 percent because

the demand growth rate steps up and they’re going to be out of

potential capacity in Chile by then. The Atacama won’t, in all

likelihood, support more than the volumes contemplated in their MOU

with CORFO plus what SQM does. Yes, there is more lithium value

potential in the Atacama, but there are water limitations and a lot

of other issues that will ultimately hinder further development.

INN: Well, the amount of growth is so huge.

JL: That’s right. Albemarle’s target of 50 percent of growth is an unreasonable goal. In addition, Albemarle is not currently the largest lithium chemical supplier in the lithium-ion space. As of now, SQM is.

INN: Worldwide, or outside of China?

JL: That’s worldwide. The way I have always calculated share is to give the credit for the share to the company that makes the lithium chemical. Given ALB is now controlling some production in China via toll, they will get share credit for that output going forward. But right now, SQM produces more carbonate than Albemarle does. If you look at July year over year, Albemarle’s exports from Chile are down a little bit, not up. SQM is up substantially. A portion likely came out of inventory, but their production is up too. On the hydroxide side, Albemarle has historically been a minor player. They will be more important going forward because they have acquired tolling capacity but their plant in King’s Mountain was, at best, marginally successful. FMC’s is currently number one of the “Big 3” in hydroxide capacity. SQM’s number two and Albemarle is number three. Later in the decade, Albemarle will probably move into the number one position as a result of the China acquisition. However, being number number one among the “Big 3” will not make them number one globally. Others in China are bigger. For the record, I do not believe FMC will ultimately triple their hydroxide capacity. Their premise that it will be easy to source carbonate as feedstock will prove to be incorrect. Look for a very limited hydroxide capacity increase from FMC.

INN: What do you see the global lithium price averaging in the next coming years?

JL: I think two things are going to happen. Carbonate: in the near term everybody is planning to build carbonate projects, except for Nemaska Lithium (TSXV:NMX) who if they get funded will focus on hydroxide. But when you look at other new projects it’s always about carbonate. Carbonate’s in short supply right now and prices have increased. On the other hand, hydroxide will have a much higher growth rate over the next five years and that market is also tight. If Tianqi is successful with their hydroxide project in Australia that will help.

The

China carbonate price has moderated from the recent all time highs

but only a limited amount. The number I’m hearing now is around

120,000 RMB/Mt, which includes VAT, which is about $18,000/Mt, plus

or minus. Hydroxide hasn’t come down like that. Hydroxide’s still

at 155,000 RMB. The

global average carbonate price (outside China) will likely settle

between $10 and $14 per kilogram over the next few years. I think

China pricing will be higher than that.

Longer

term, carbonate stays in the low double digits to low teens outside

of China–and a little bit higher inside of China–just because of

the supply and demand dynamics. This seems the situation until at

least 2021. For

those most part, China’s a carbonate-based cathode market. Japan’s,

generally speaking a more hydroxide-based cathode market now because

so much of what is happening is related to NCA/Tesla (NASDAQ:TSLA)

with Panasonic currently the cell supplier. Korea is also mostly

carbonate now but hydroxide based cathode production is growing

largely due to more use of high nickel NMC.

In

my opinion, there’s going to have to be a much higher premium for

hydroxide versus carbonate than there has been historically, in order

for the “Big 3” to invest in hydroxide capacity outside of China.

The Big 3 hydroxide production process (except for ALB tolling in

China) uses lithium carbonate as feedstock.

In

China, they make hydroxide or carbonate from a common lithium

solution. Most production in China is based on lithium sulfate

produced from spodumene. The cash cost of carbonate vs

hydroxide isn’t exactly the same, but it’s close. They have

a bias to make hydroxide if they can sell it for a higher price,

especially for their exports. I see that happening now.

INN: Are any of the juniors in the market that you think have got a better chance than most to succeed?

JL: I’m a fan of Galaxy Resources (ASX:GXY). Everybody criticizes Lithium Americas (TSX:LAC) for the deal with SQM. I think it will actually prove to be very smart for both parties. I am hoping they both GXY and LAC secure the capital to start construction soon. If you looked at social media, or went on any website where people commented on it, many were critical because they said, “they should have gotten an Orocobre (TSX:ORL) like valuation.” Well, no they shouldn’t have. Orocobre was and still is overvalued despite their recent stock price slide.

INN: Any of the commodities that don’t have a future or aren’t traded on the LME are difficult for the average investor to understand and they’re hard for the banks to deal with too. The banks seem to be the biggest people who struggle.

JL: I can’t tell you how many metal traders have contacted me wanting to start a trading desk or an arbitrage vehicle. That is not where my interest lies.